Sudan has revived negotiations with Russia to procure Su-30 or Su-35 multirole fighter jets, a move driven by the Sudanese Armed Forces’ urgent need to counter Rapid Support Forces (RSF) gains and rebuild an air fleet heavily degraded during the civil war. The talks, according to multiple regional defense sources, are increasingly tied to Moscow’s long-standing ambition to establish a naval logistics hub on the Red Sea, turning the potential arms purchase into a broader geopolitical bargaining process.

A Dual-Track Negotiation: Combat Aircraft for Naval Access

Reports from Military Africa on November 19, 2025, indicate that Russia is positioning its advanced fighter jets as part of a strategic package that could grant it permanent maritime access in Port Sudan. For Sudan, the acquisition would restore lost deep-strike capacity against the RSF; for Russia, it would provide a major foothold along one of the world’s most critical maritime chokepoints.

Sudan’s Air Force Scramble: Combat Losses Drive Urgent Procurement

The Sudanese Air Force suffered extensive losses in the opening weeks of the conflict in April 2023, when RSF units overran key bases such as Merowe, destroying or capturing several MiG-29 fighters. Since then, Sudanese forces have relied on a patchwork fleet including:

- Aging Su-24M bombers

- Legacy Su-25 ground attack aircraft

- Mixed Chinese-origin aircraft with limited readiness

Meanwhile, the RSF significantly strengthened its air defense capabilities, deploying MANPADS, Wagner-linked mobile systems, and—by mid-2025—allegedly receiving FK-2000 and FB-10A short-range air defense systems via Chad.

A Search for 4+ Generation Fighters

In response to these setbacks, Sudan has drafted a “4+ generation” procurement list centered around:

- Russia’s Su-30

- Russia’s Su-35

- China’s J-10 (as a fallback option)

Su-30 and Su-35: Capabilities Sudan Seeks to Regain Air Dominance

Su-30: Long-Range Multirole Workhorse

The Su-30 offers Sudan:

- Long endurance and heavy payload

- Strong all-weather strike capability

- Radar and fuel reserves enabling missions over 3,000 km

- Potential integration of aerial refueling

These attributes would allow Khartoum to target RSF supply corridors, command hubs, and remote logistics sites.

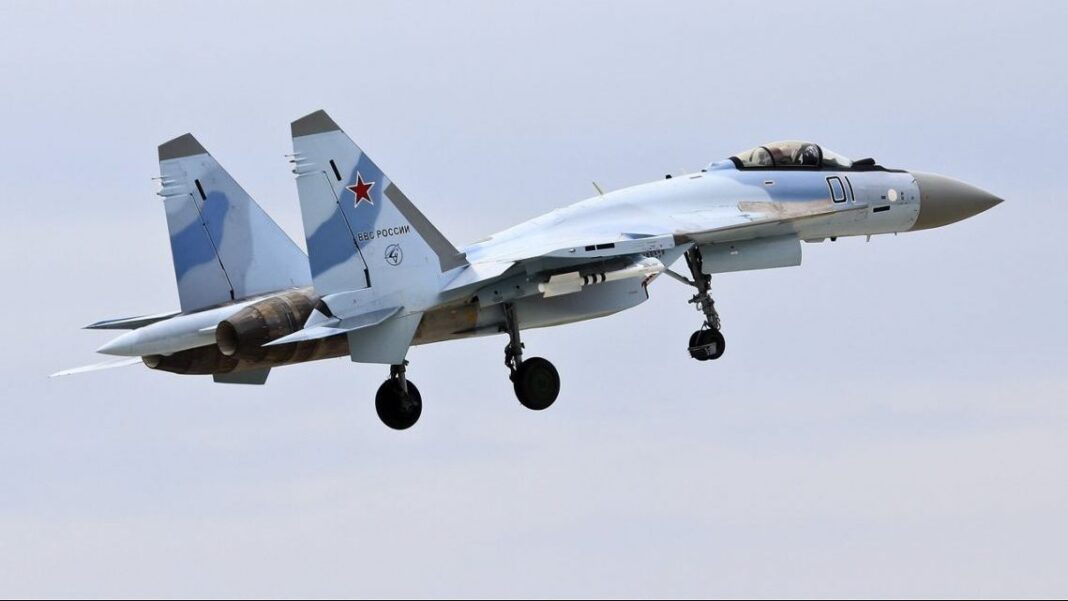

Su-35: Russia’s Most Advanced 4.5-Generation Fighter

Derived from decades of Su-27 development, the Su-35 features:

- AL-41F1S thrust-vectoring engines

- High-g maneuverability and limited supercruise

- Irbis-E radar with detection ranges up to 400 km

- OLS-35 IRST and Khibiny-M EW suite

- 12 hardpoints and 8,000 kg weapons load

It is capable of carrying long-range air-to-air missiles, precision-guided bombs, and even anti-ship weapons like the P-800 Oniks.

Global Track Record and Export History

The Su-35 entered Russian service in the 2010s and has since:

- Served extensively in Syria

- Been deployed in the Ukraine conflict

- Been exported to China, with Algeria and Iran expressing repeated interest

However, sanctions and geopolitical constraints have hindered potential sales to Egypt, Indonesia, and others.

Historical Context: Sudan’s Unfulfilled Su-35 Agreement

Claims emerged in 2017 suggesting Sudan had already obtained Su-35s, but no evidence ever surfaced. Analysts now view those reports as premature political signaling during efforts to expand bilateral ties in mining, energy, and defense technology.

Sudan’s Financial Limitations: Why Strategic Barter Is the Only Option

Defense Budget Too Small for Conventional Purchases

With Sudan’s annual defense spending estimated around $500 million even before the war, acquiring multibillion-dollar fighter aircraft through traditional purchases is impossible. This financial reality increases the likelihood of:

- Offset agreements

- Strategic concessions

- Long-term military basing arrangements

Russia’s Red Sea Naval Base Effort Resurfaces

Moscow has pursued rights for a naval logistics facility in Port Sudan since 2020. The base would:

- Provide year-round access to warm waters

- Support long-range deployments into the Indian Ocean

- Expand Russian maritime influence near a major global trade artery

The plan stalled after Sudan’s 2021 coup and the escalation of civil conflict. However, senior Sudanese officials—including General Yassir al-Atta—have recently confirmed that discussions have restarted and explicitly linked Russian support to the base agreement.

Acting Foreign Minister Ali Yusuf has also acknowledged Moscow’s involvement as part of a broader alliance supporting Sudan’s military.

A High-Stakes Deal With Regional Implications

A jets-for-base arrangement would reshape regional security dynamics, affecting:

- Egypt and Saudi Arabia

- Ethiopia and Eritrea

- Western maritime powers concerned about Russian projection in the Red Sea

For Sudan, the deal offers a potential lifeline against the RSF. For Russia, it offers one of the most strategically valuable naval positions on the African coast.

What emerges from these negotiations will determine not only the trajectory of Sudan’s war but also the balance of power across the Red Sea corridor.